IFTA Reporting Software for Accurate Fuel Tax Compliance

IFTA, or the International Fuel Tax Agreement, is an agreement among the 48 contiguous U.S. states and 10 Canadian provinces designed to simplify the reporting of fuel taxes by interstate motor carriers. Rather than requiring truckers to file individual fuel tax reports in each state or province they operate in, IFTA allows them to file one consolidated quarterly report with their base jurisdiction. This report covers all the fuel purchased and miles traveled in each IFTA jurisdiction.

IFTA reporting involves tracking the miles driven in each state or province and the fuel purchased in each jurisdiction. The goal is to ensure that taxes are paid fairly and accurately based on where the fuel was used, regardless of where it was purchased.

Ezlogz is more than just an IFTA reporting tool. We are a complete fleet management software designed to help trucking companies streamline their truck logging operations. With features like ELD compliance, route optimization, and real-time tracking, we provide a complete solution for managing your fleet efficiently and staying compliant with industry regulations.

By choosing Ezlogz, you’re not just simplifying your IFTA reporting process—you’re investing in a software that grows with your business, helping you save time, reduce costs, and operate more effectively.

To comply with IFTA reporting requirements, carriers must maintain detailed records of their fuel purchases and miles traveled in each jurisdiction. These records include

Elevate your fleet operations

with Ezlogz's innovative solutions

Key features

IFTA miles tracking

Automatically records vehicle mileage across jurisdictions using GPS, eliminating manual input for accurate data.

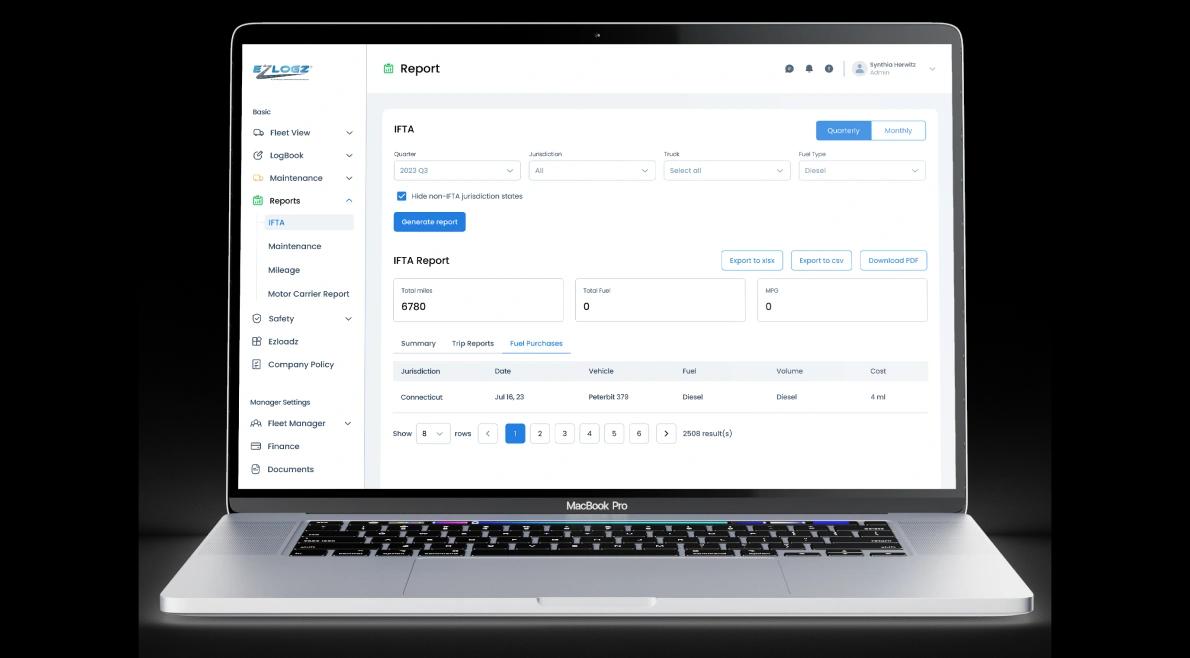

Report option

Generates complete IFTA reports with all fuel and mileage data in just a few clicks.

Different filters

Customize reports by vehicle, date range, or jurisdiction for detailed insights and analysis.

Download report

Easily download reports in various formats for reviewing, submitting, or sharing with relevant authorities

IFTA fuel tax reporting simplified

Ezlogz’s IFTA Reporting Software automates everything from mileage tracking to fuel receipt recording, ensuring you have all the data you need to file your quarterly reports on time. Instead of dealing with paperwork, spreadsheets, and endless calculations, you can generate your IFTA reports in minutes. Our software saves you time, reduces errors, and helps you avoid costly penalties from non-compliance.

What is the IFTA reporting form?

One of the most complex aspects of IFTA is calculating the fuel taxes owed to each jurisdiction. Each IFTA jurisdiction has its own tax rate, and the amount you owe is based on the number of miles driven in each area and the amount of fuel purchased. Ezlogz’s IFTA Reporting Software simplifies this process by handling the calculations for you. After compiling all this data, the software generates a report that shows you exactly what is owed to each jurisdiction. With Ezlogz, you can file your report quickly and avoid any issues with underpayment or overpayment of taxes.

The software automatically pulls mileage data from your fleet’s GPS tracking and pairs it with fuel purchases recorded through receipts or fuel cards. It then calculates the amount of tax owed in each jurisdiction by considering the following

Benefits of Using Ezlogz IFTA fuel tax reporting software

Automated mileage tracking

Fuel data integration

Instant calculations

Easy reporting

Real-time insights

Compliance assurance

Gross vehicle weight

Any vehicle with a gross vehicle weight of over 26,000 pounds (11,797 kg) is required to display an IFTA decal.

Axles

If your vehicle has three or more axles, regardless of weight, you need an IFTA sticker.

Combined weight

Vehicles with a combined weight exceeding 26,000 pounds, including trailers, must also be IFTA-compliant.